INVESTMENT OPPORTUNITY

We offer a unique investment opportunity focused on acquiring efficiently operated PDP

(Proved Developed Producing) wells, providing investors with predictable, stable cash flow without the risks of drilling new wells. By targeting mature, underperforming assets, we reduce risk while enhancing returns through operational improvements,

offering steady, long-term profitability.

No Speculative Drilling

The strategy avoids high-risk wildcat exploration. Instead, we focus exclusively on acquiring low-decline, cash-flowing PDP assets with known performance histories eliminating the uncertainty of dry holes or failed completions.

Real Asset Ownership, Not Public Equities

Unlike public energy stocks or synthetic ETFs, investors hold a direct working interest in physical production, offering transparency, control, and tangible asset exposure.

Proven, Repeatable Strategy

Our operating team has successfully implemented this model across multiple basins and transactions. The process—from acquisition to optimization to exit—has been refined and stress-tested in real market conditions.

INVESTMENT OPPORTUNITY

We offer a unique investment opportunity

focused on acquiring efficiently operated PDP

(Proved Developed Producing) wells, providing investors with predictable, stable cash flow without the risks of drilling new wells. By targeting mature, underperforming assets, we reduce risk while enhancing returns through operational improvements, offering steady, long-term profitability.

No Speculative Drilling

The strategy avoids high-risk wildcat exploration. Instead, we focus exclusively on acquiring low-decline, cash-flowing PDP assets with known performance histories eliminating the uncertainty of dry holes

or failed completions.

Real Asset Ownership, Not Public Equities

Unlike public energy stocks or synthetic ETFs, investors hold a direct working interest in physical production, offering transparency, control, and tangible asset exposure.

Proven and extremely

Repeatable Strategy

Our operating team has successfully implemented this model across multiple basins and transactions. The process—from acquisition to optimization to exit—has been refined and stress-tested in real market conditions.

Amount

of Return (IRR)

Period (Months)

Pre-Capital Recovery

Post-Capital Recovery

Proceeds Upon Exit

Targeted Net IRR

To LP Investors

Investors are presented with a compelling opportunity to earn a targeted net annual internal rate of return (IRR) between 24% and 29%, achieved through a combination of monthly cash flow and back-end exit proceeds.

Monthly Cashflow

Begins within 60-90 Days of Acquisition

By acquiring already-producing PDP wells, investors begin receiving monthly distributions within 60–90 days of closing, supported by existing production infrastructure and sales contracts. No waiting on new development or permitting for 6-12 months like drilling.

24 - 36 Month

Full Capital Return

The investment is structured for full capital return to all LP Investors within approximately 24-36 Months through operational Net cash flow.

Returns will then continue after full capital return at the "Phase 2" of the Waterfall returns

Multiple Acquisitions

Combined into a Fund

By aggregating several producing fields into a single fund, OWP creates a diversified portfolio that reduces asset-specific risk and enhances the fund's value at exit. This “bundled exit” strategy is more attractive to institutional buyers seeking scale, consistency, and operational efficiency.

Private Capital Debt

Standard 5 Year Full Repayment

Each acquisition is financed using a mix of investor equity (OWP) and fully amortized debt (Private Capital) typically over a 5-year term. Monthly cash flow from producing assets is used to pay down principal and interest, ensuring the portfolio is entirely debt-free by the time of exit.

5 Year Hold Term

Total Duration of the Fund

The standard five-year hold allows time to fully optimize each field, reduce private capital debt, and maximize tax advantages such as IDC and depletion. It also aligns with most middle market buyer's, enhancing resale value and improving the likelihood of a clean, profitable exit due to accumulated combined asset value

Tax Incentives

Oil & Gas Specific Rules

Investors may benefit from significant tax advantages including up to 100% deductions for intangible drilling costs (IDCs) and 15–25% annual depletion allowances—allowing income to be offset against other sources, subject

to individual tax situations.

Targeted Net IRR

To LP Investors

Investors are presented with a compelling opportunity to earn a targeted net annual internal rate of return (IRR) between

24% and 29%, achieved through a combination of monthly cash flow

and back-end exit proceeds.

Monthly Cashflow

Begins within 60-90 Days of Acquisition

By acquiring already-producing PDP wells, investors begin receiving monthly distributions within 60–90 days of closing, supported by existing production infrastructure and sales contracts. No waiting on new development or permitting for 6-12 months like drilling.

24 - 36 Month

Full Capital Return

The investment is structured for full capital return to all LP Investors within approximately 24-36 Months through operational Net cash flow. Returns will then continue after full capital return at the "Phase 2" of the Waterfall returns

Multiple Acquisitions

Combined into a Fund

By aggregating several producing fields into a single fund, OWP creates a diversified portfolio that reduces asset-specific risk and enhances the fund's value at exit. This “bundled exit” strategy is more attractive to institutional buyers seeking scale, consistency, and operational efficiency.

Private Capital Debt

Standard 5 Year Full Repayment

Each acquisition is financed using a mix of investor equity (OWP) and fully amortized debt (Private Capital) typically over a 5-year term. Monthly cash flow from producing assets is used to pay down principal and interest, ensuring the portfolio is entirely debt-free by the time of exit.

5 Year Hold Term

Total Duration of the Fund

The standard five-year hold allows time to fully optimize each field, reduce private capital debt, and maximize tax advantages such as IDC and depletion. It also aligns with most middle market buyer's, enhancing resale value and improving the likelihood of a clean, profitable exit due to accumulated combined asset value

Tax Incentives

Oil & Gas Specific Rules

Investors may benefit from significant tax advantages including up to 100% deductions for intangible drilling costs (IDCs) and 15–25% annual depletion allowances—allowing income to be offset against other sources, subject to individual tax situations.

But the REAL question......

How is the Cash-Flow Distributed?

But the REAL question......

How is the Cash-Flow Distributed?

Capital Return

waterfall structure

80% Net Profit Share to LP Investor's

LP Investors receive 80% of all net cash flow until their original investment is fully returned, ensuring alignment and priority income treatment to recover that initial investment at an accelerated rate of return.

The managers (GP's) receive remaining 20%.

50% Net Profit Share to LP Investor's

Once capital is recovered to the LP Investor's, all future net profits from cashflow are split evenly between the LP's & GP's, creating long-term alignment between investors and the sponsor for the success of the assets

50% Net Profit Share to LP Investor's

OWP targets a 5-year exit through a bundled portfolio sale. By then, assets are optimized, debt-free, and investor capital has been fully returned. Combining multiple producing fields often increases total valuation due to scale and buyer appeal. Exit profits are split 50/50 with investors, supporting the targeted IRR.

Capital Return

waterfall structure

80% Net Profit Share

to LP Investor's

LP Investors receive 80% of all net cash flow until their original investment is fully returned, ensuring alignment and priority income treatment to recover that initial investment at an accelerated rate of return. The managers (GP's) receive remaining 20%.

50% Net Profit Share

to LP Investor's

Once capital is recovered to the LP Investor's, all future net profits from cashflow are split evenly between the LP's & GP's, creating long-term alignment between investors and the sponsor for the success of the assets

50% Net Profit Share

to LP Investor's

OWP targets a 5-year exit through a bundled portfolio sale. By then, assets are optimized, debt-free, and investor capital has been fully returned. Combining multiple producing fields often increases total valuation due to scale and buyer appeal. Exit profits are split 50/50 with investors, supporting the targeted IRR.

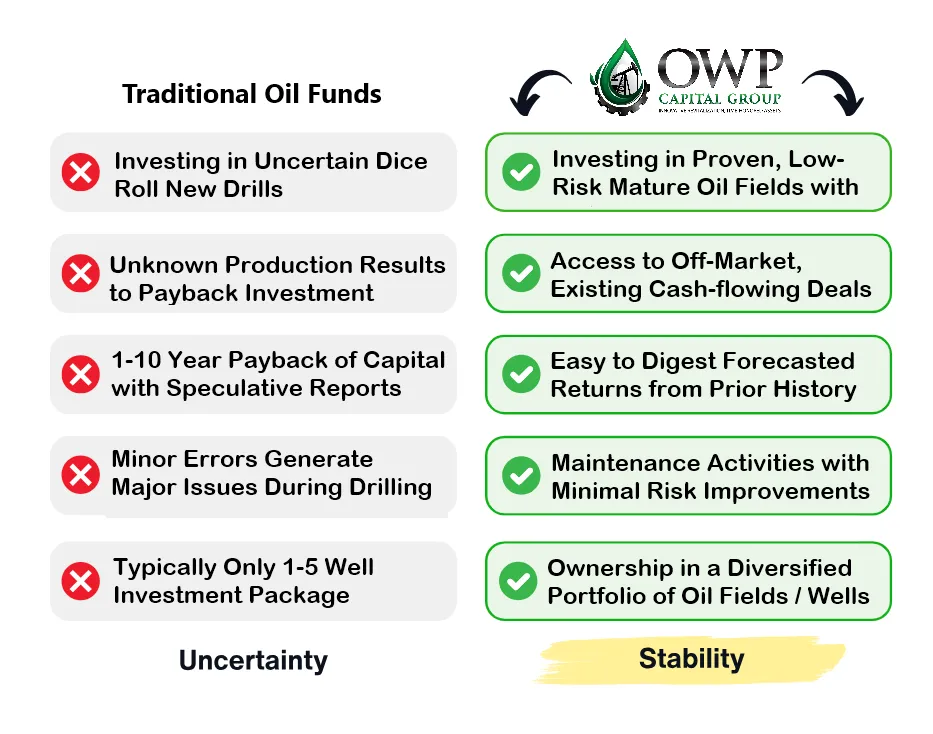

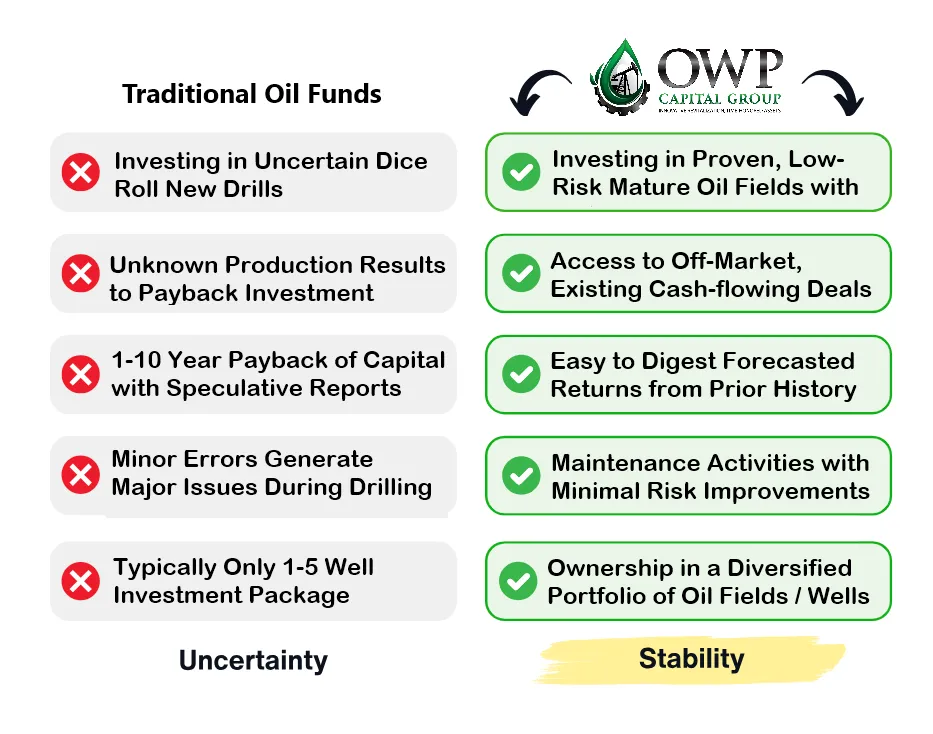

If it isn't already clear how we have brought risk mitigation to Oil & Gas

Here is a comparison....

If it isn't already clear how

we have brought risk mitigation to Oil & Gas

Here is a comparison....

Click for a 6 minute video

explaining our fund

Disclosures : OWP Capital Group conducts offerings pursuant to Rule 506(c) of Regulation D under the Securities Act of 1933, as amended. These offerings are exempt from SEC registration, but are available only to accredited investors as defined in Rule 501 of Regulation D. Accredited investors may include Individuals with net worth exceeding $1 million (excluding primary residence), or Individuals with annual income over $200,000 ($300,000 jointly with a spouse or partner) in each of the past two years, with a reasonable expectation of the same for the current year. Certain legal entities with sufficient assets or institutional qualifications also qualify. As a 506(c) offering, OWP Capital Group is permitted to market publicly (including through digital channels, webinars, or events), but is required to take reasonable steps to verify the accredited investor status of all participants. This verification must occur prior to accepting investment capital and involves collecting supporting documentation such as financial statements, W-2s, tax returns, or verification letters from licensed professionals.

Investors will receive access to a Private Placement Memorandum (PPM), subscription documents, and other fund disclosures through a secure investor portal. All investment decisions should be made based solely on a thorough review of these materials. Participation in the fund does not establish an advisory or client relationship between investors and OWP Capital Group or any affiliated third parties. OWP Capital Group does not provide investment advice, tax planning, or legal counsel. Investors are encouraged to consult their own advisors before making an investment. Investments in private placements involve significant risk, including the potential loss of principal, illiquidity, and long holding periods. These offerings are intended for investors who can withstand a total loss of their investment and who do not require immediate liquidity.

No representation is made regarding the accuracy or completeness of information, and all materials are subject to change without notice. Prospective investors are strongly encouraged to review

all offering materials in full and to consider the risk disclosures provided in the PPM before investing.

Past performance is not indicative of future results. Certain statements made by OWP Capital Group may be forward-looking in nature, reflecting current expectations and projections related to operations, returns, or fund performance. These statements are subject to a variety of risks and uncertainties that may cause actual outcomes to differ materially. No assurance can be given that targeted results, including projected IRRs, cash flow, or return of capital timelines, will be achieved. All data presented by OWP Capital Group is based on internal analysis and assumptions and has not been independently verified unless otherwise noted.

Facebook

Instagram

LinkedIn

Youtube